How to be scam smart

Your pension is one of your most valuable financial assets, built up over years of hard work to support your future. Unfortunately, this makes it a prime target for criminals.

Pension scams are on the rise, with fraudsters employing increasingly sophisticated methods to steal lifetime savings in moments. But by understanding the common tactics scammers use and knowing what to look out for, you can take steps to protect your retirement funds.

How to spot a pension scam

We would always recommend that you exercise extreme caution if someone asks you to move your money. However, there are some common signs of pension scams that you can look out for:

Unsolicited contact: Be cautious of unexpected phone calls, texts, emails, or doorstep visits offering pension advice or reviews. Cold calling about pensions has been banned since January 2019.

High-pressure tactics: Scammers often rush you to make quick decisions, transfer funds, or sign documents. Legitimate firms will never pressure you.

Too-good-to-be-true offers: Promises of high returns with low risk, early pension access before age 55, or unique “one-off investments” are red flags.

Untraceable contact details: Avoid firms with only mobile numbers, and unregistered trading names, and verify contact information through official channels.

Claims of tax loopholes or government initiatives: Be skeptical of promises to help you unlock tax savings or access more than the usual 25% tax-free when taking benefits.

Free pension reviews: Offers of “free reviews” are often scams designed to gain access to your pension details.

Don't let a scammer enjoy your retirement

How to protect yourself

Here are a handful of tips that can help you avoid falling victim to a scammer.

Verify the firm’s credentials: Check the FCA register↗ and HMRC status of any firm or adviser. Be wary of authorised schemes involving unregulated, high-risk investments.

Get independent advice: Consult FCA-regulated financial advisers and shop around for multiple opinions before making any decisions.

Trust your instincts: If something feels wrong or sounds too good to be true, stop and seek advice. Never give out personal information or sign documents without consulting a trusted professional.

What to do if you think you've been scammed?

Unfortunately, anyone can fall victim to scammers, and there's support available if you think you've been scammed. Here's what you can do:

①

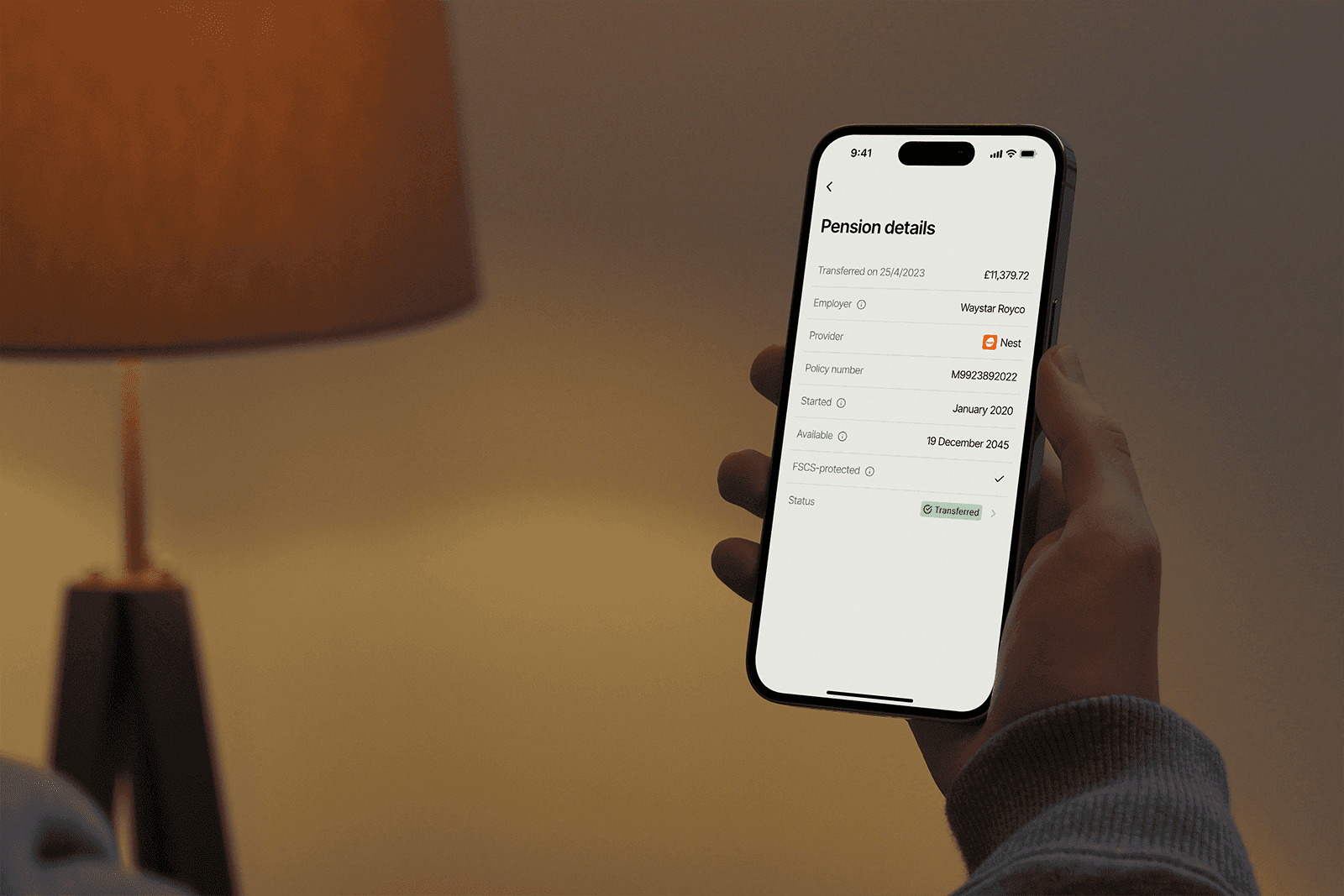

Contact your pension provider straight away. They might be able to stop a transfer that hasn’t taken place yet.

②

Report it on the FCA Scam Smart website↗ and to Action Fraud on 0300 123 2040 or on the Action Fraud website↗.

③

Call MoneyHelper on 0800 138 7777 (or 0800 138 3944 for Pension Wise if aged 50+) to speak with a pensions specialist for guidance and support. They offer free information but not regulated advice.